- Democratize Venture

- Posts

- The Dreaded Panic Attack

The Dreaded Panic Attack

(Plus: The new trend of investing in "Pre-IPO" companies)

Delivered February 14, 2025 @ 5:00pm ET

Table of Contents

Welcome! ✋

Happy Valentines Day 💘!

My name is Gerry Hays, and for lack of a better description, I’m the custodian and convener of Doriot, a movement to break open the gates of venture and expand opportunity beyond an elite few.

I’ve been in the game of venture as a founder, investor, researcher, inventor, author, game designer, and professor. I’ve built companies and developed a global venture portfolio entirely from the great state of Indiana, all while teaching over 6,000 undergraduates and MBAs at Indiana University, as well as in Croatia, Hong Kong, Slovenia, and Singapore.

Democratize Venture reflects my take on venture — exploring how we can create new, more inclusive systems based on what I believe is relevant and important today — and insights into the mental strategies behind wealth building, a core aspect of venture. Much of what I share stems from discussions I have in the classroom.

This Week’s Highlights in the Democratize Venture Space

Nothing caught our eye

The Dreaded Panic Attack

“Trying to act calm and confident with social anxiety”

-SpongeBob

Panic attacks are real. Just this week, I spoke with a loved one experiencing one in real time over the phone, prompting me to write about it here.

I get it. The stakes are high, and that creates pressure. Panic can take over, with the body reacting to stress through overwhelming fear, dread, or even physical symptoms that mimic a heart attack.

I’ve had my share of high-pressure situations—especially with Doriot. And I’m not alone. Research shows that 10% of founders experience panic attacks.

But here’s the truth: Panic attacks don’t mean we’re weak. They mean we care. They mean we’re in the arena, doing the hard thing.

And if you’ve been reading this newsletter, you know I believe in Venture Alchemy—the convergence of mindset, strategy, and execution. The key isn’t avoiding the fire, it’s using it to your advantage.

Where Panic Attacks Come From

Panic attacks stem from a battle between uncertainty and control. Founders live in the Grit Zone, pushing forward despite unknowns. But when uncertainty becomes overwhelming—when traction stalls, when imposter syndrome whispers—our nervous system triggers a fight-or-flight response.

For me, with Doriot, I’ve spent over seven years testing, learning, and failing more than I ever imagined. Some of my closest friends and mentors have invested in me, yet I haven’t produced outcomes that resemble objective success. Meanwhile, scrolling LinkedIn, it seems like every founder is “crushing it”.

After successfully building and selling companies, and after 20 years of teaching Entrepreneurial Finance and Venture Capital, you’d think I’d have all the answers. In entrepreneurship, success—depending on the project—is often a journey of repeated failures. That reality brings pressure and pain, especially the fear of failing.

How I deal with the Pressure and Fear as a Founder?

The answer is mindset practice—the first component of Venture Alchemy. While it may not show immediate benefits, over time, it cultivates clarity, reduces confusion, and brings peace—critical for perseverance and a clear mind.

Here are three strategies I’ve used (and continue to use):

1. Breathe

I joined a weekly breathwork group with other founders. It’s been a game-changer. Intense emotions of fear course through me, only to leave me calmer and at peace by the end. Breathing is a reset. And, I notice a difference if I don’t make a session.

2. Assume the Worst Has Already Happened and Carry on

A few months ago, I was in a really dark place, so I confronted my fear head-on: “Doriot has failed. Ok, now what?” I just accepted it as true, and suddenly, there was nothing left to fear. While the feeling of “what if we truly fail to find a break-thru” still arises, it’s far less intense than before. At this point, I have nothing to lose and everything to gain by staying in the game for the one shot we need to change the narrative.

3. Find a Faith Anchor (Whatever That Means to You)

For some, faith means trusting in a higher power. For others, it’s faith in the process, the compounding effect of effort, or the belief that setbacks are setups for breakthroughs. Whatever it is, lean into it. Faith turns chaos into context.

For me, my wife and I start and end each day with words of gratitude and a short prayer—not for outcomes, but for clarity and strength to stay present. The more I stay present, the more my focus increases, and the less I succumb to fear-based thoughts.

In closing, the journey of building a company can’t be 100% about the doing. We must put as much effort into managing our internal fears and anxieties as we do into the work itself, because in entrepreneurship, facing the insurmountable is inevitable.

Investing in “Pre-IPO” Companies

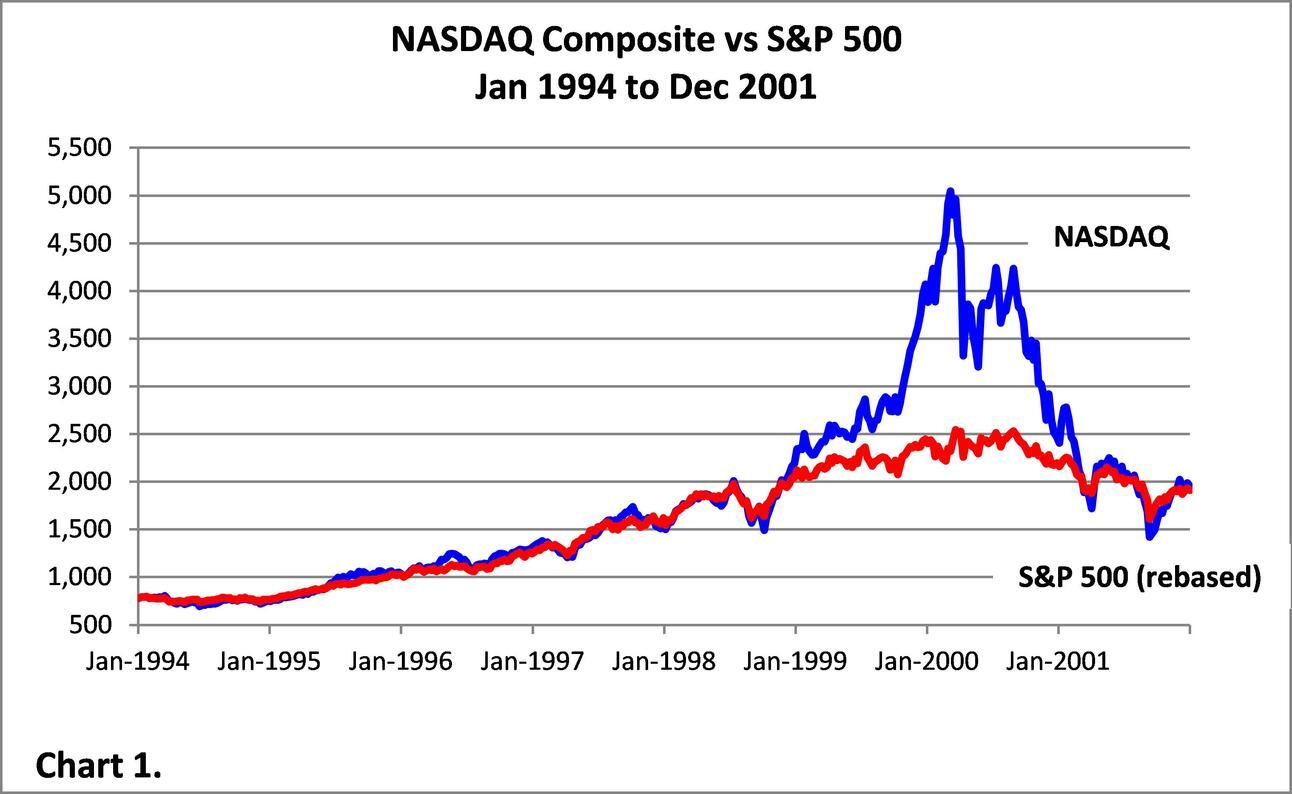

In the late 1990s, investors eagerly sought pre-IPO shares in dot-com companies, anticipating immediate gains upon public listing. This strategy thrived until the market crash in March 2000.

Dot Com Era

Recently, a similar trend has emerged, with platforms like StartEngine offering accredited investors opportunities to invest in pre-IPO giants such as OpenAI, SpaceX, and Databricks. The premise is that early investment in these firms will yield substantial returns once they go public.

But proceed with caution. Many of these companies have not announced intentions to go public. For instance, OpenAI's CEO, Sam Altman, has expressed reservations about an IPO due to the company's unique structure and potential legal challenges. Similarly, SpaceX, valued at approximately $350 billion, has not indicated plans for a public offering

Today’s IPO landscape is vastly different from the early 2000s. With an abundance of private capital and regulatory hurdles like Sarbanes-Oxley, the complexity and cost of going public have made it less appealing for many firms. Additionally, during the IPO roadshow, companies must justify their private valuations to institutional investors. WeWork’s original IPO was a debacle, with its valuation plummeting from $47 billion to $4 billion under public scrutiny.

Once a company goes public, it must disclose all material information in a timely manner, face SEC scrutiny, and answer to Wall Street analysts every 90 days. That’s a completely different game from leading a privately backed company, where satisfying a handful of stakeholders is enough and you don’t have to build in public.

If you invest in these pre-IPO deals, you may be locking up your capital for years. And if the company doesn’t see massive valuation jumps before they IPO, have you really captured enough upside to justify the risks and illiquidity as compared to those that buy into these companies post IPO?

Thus, while the allure of pre-IPO investments might seem compelling on the surface, the reality is that you may just be cashing out insiders who want to maintain the status quo while also seeking liquidity, which is one of the biggest reasons companies IPO. This makes me wonder if these secondary markets are actually incentivizing companies to stay private longer. 🤔

Doriot Deal Updates

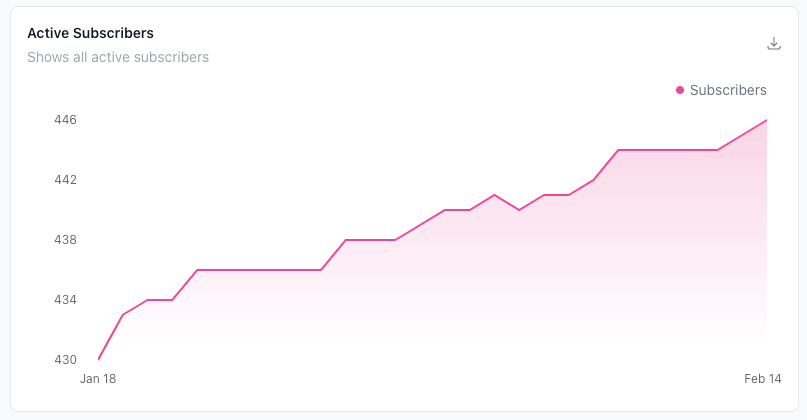

Kingscrowd launched another round on Start Engine. We’re going to review the latest offering the week of the February 23.

Bepo deal review dropped this week!

Bepo, a digital platform enabling customers to tip service workers electronically, is currently raising on Wefunder. We took a deep dive into the online tipping market, the company, and its team to assess whether Bepo has what it takes to become a major player in the space. Check it out here:

Have a great weekend! -gerry ([email protected])

Reply