- Democratize Venture

- Posts

- Genius, iPhone, and Pickleball?

Genius, iPhone, and Pickleball?

(And why Founders need to re-think Valuation)

Delivered October 25, 2024 @ 5:00pm ET

Table of Contents

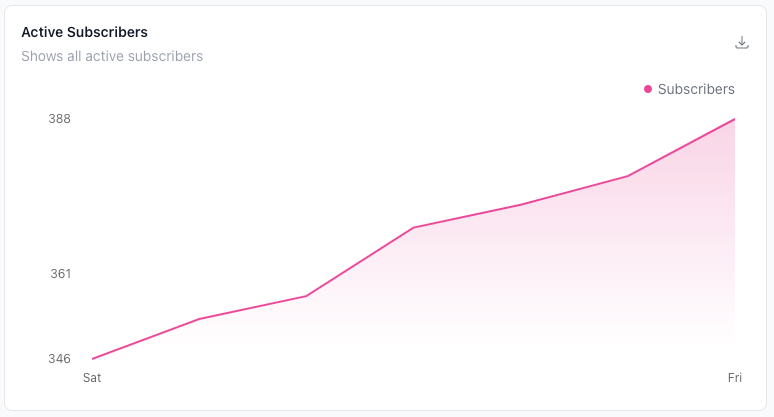

Welcome new members! 🖖 “Democratize Venture” subscribers - Last 7 Days👆️

Happy Friday everyone! My name is Gerry Hays, and I’m the Founder of Doriot (pronounced: dor-ee-oh).

I’m actively in the venture game as a Founder/CEO, investor, researcher, inventor, author, game designer, and professor. I’ve built companies and developed a global venture portfolio entirely from the great state of Indiana, all while teaching over 6,000 undergraduates and MBAs at Indiana University, as well as in Croatia, Hong Kong, Slovenia, and Singapore.

I’m devoting the remainder of my professional career to democratizing venture.

Why is democratizing venture so important?

The future is uncertain. Humanity needs pioneers and speculators from all walks of life—not just the wealthy and elite.

Thus, I see venture as a platform to attract and educate a broader range of pioneers and speculators who want to build wealth helping shape the future trajectory of humanity, rather than leaving it in the hands of a select few.

Central to this mission is teaching how to succeed in venture without endless capital and elite connections. It involves adopting and integrating what I call Venture Alchemy: a disciplined process that transforms bold ideas and capital into valuable outcomes, where mindset, strategy, and execution converge. This formula was applied by Georges Doriot, the Father of Venture Capital.

Thus, each week, I explore a component of Venture Alchemy, applicable to many areas of life, along with key lessons on the business of venture as the foundation upon which a new venture system might emerge.

If you’re enjoying this newsletter and think others in your network would too, I’d be grateful if you forwarded it along and encourage them to subscribe.

Venture Alchemy - This Week’s Discussion

"Any intelligent fool can make things bigger and more complex… It takes a touch of genius - and a lot of courage - to move in the opposite direction."

This quote, often misattributed to Albert Einstein, actually comes from Ernst F. Schumacher, a British economist known for advocating human-scale, decentralized, and appropriate technologies. Let’s break down what he means.

It’s easy to complicate things - just like it’s easier to write a 20-page paper than a 1-page paper that makes a clear point, or to explain something in an hour rather than coherently in 60 seconds. In product development, anyone can add layers, features, or endless options, believing complexity signals superiority. In the startup world, this is called "feature creep" - a highly flawed (and capital-inefficient) process. If the underlying value proposition isn’t compelling, no amount of complexity (and marketing) will fix it.

Take the original iPhone: while its technology was complex, the simplicity of its design and interface was revolutionary - it transformed how we think about phones. The iPhone wasn’t the first smartphone; Nokia, 3Com, HP, and Research in Motion all had smartphones on the market. But Steve Jobs understood that simplicity was essential to building a massive market. And, as a result, Apple became the dominant player in the smartphone industry.

In the context of launching a new company or product using the Venture Alchemy process, once a problem has been identified, here’s how to approach the next steps:

Mindset – Continually shift your focus away from what exists today (including others’ opinions and existing solutions) to understand the core of the problem at a first-principles level.

Strategy – Refine a potential solution until a simple, clear path to resolve the root pain points has been discovered. This is where genius comes into play.

Execution – Reduce company actions down to clear, repeatable steps that can be efficiently scaled as market demand increases.

Tennis Anyone?

In theory, with new SEC regulations, non-millionaire investors now have access to venture markets. But by all objective measures, the Retail Venture Markets haven’t grown as anticipated, and a Wall Street Journal article posted this week even suggests the Angel Venture market is in decline.

We know the surface problems: startup investing is high-risk, deals are hard to find and qualify, and access often depends on money, networks, or both. So, it would seem that democratizing venture is a highly complex challenge that may never be solved (or so most venture capitalists believe). And, in fairness, hundreds of millions have already been spent trying to tackle this problem.

However, after examining this problem at the first-principles level, the real issue is straightforward: we're attempting to force the traditional venture model - a heavily gated and complexed system designed for professional (i.e. salaried) investors - onto angel and retail investors, and it simply doesn’t fit.

Thus, we need a modern form of venture for individual investors who have day jobs but want to play/invest at a competitive level. Allow me to frame it in even more simplistic terms:

Traditional Venture = Tennis

Modern Venture = Pickleball

This modern form of venture (played on the same court) offers thrill, accessibility, outsized profit potential, and downside protections. We’ve termed it Venture Staking and believe it represents a quantum leap for individual venture investors in the quest to truly democratize the venture markets. Stay tuned!

Why Founders need to rethink Valuation

Last week, I went out on a very short and sturdy limb with the claim that valuations are out of whack. There I remain perched.🦉

But valuation is a topic that stirs all sorts of emotions, especially among founders. Founders have been conditioned to view valuation as a proxy for accomplishment and control. If they raise at a high valuation, it must mean they’ve already built something great, and they get to keep a tight grip on the wheel. Investors are often willing to play along because they want to appear “founder-friendly.” But having been burned before, I would never invest in founders optimizing for valuation and control, no matter what they claim to be doing.

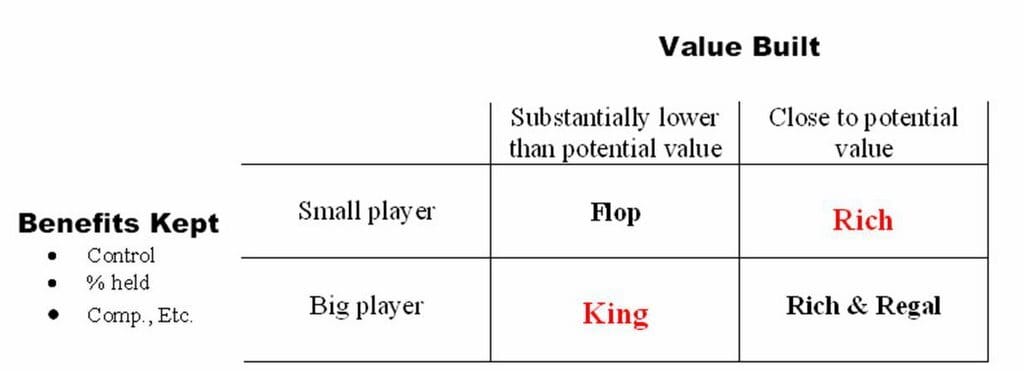

Back in 2006, Harvard professor Noam Wasserman wrote a compelling book called The Founder’s Dilemma. He aptly pointed out that founders ultimately need to make a critical decision: do they want to be rich, or do they want to be kings/queens? Because rarely do they get the luxury of both.

Ultimately, as founders, the smart play is to put the company’s needs ahead of personal ambition in the pursuit of delivering tremendous value to the market. This means making room for smart investors and team members who share in the financial rewards and help navigate the journey. It requires pricing deals correctly at each stage (even if we could get away with more). The reason? When everyone on the cap table feels valued and appreciated, then, when times get tough (and they will), our investors and team will stand by us. I believe this alignment has far more value than any superficial number on a piece of paper.

I bring this up in class, and inevitably, someone asks why anyone would want to raise venture capital if it means giving up so much ownership (and control). My typical response is that control is a derivative of delivering results - which, as CEO, you get to drive. Plus, Mark Zuckerberg owns just 13.5% of Meta (i.e., if you want to be a billionaire, build a multi-billion-dollar company).

Then I offer two career options for them to consider:

Option 1 – Stay in corporate, earn a competitive salary, and compete for promotions and/or jobs at different companies; or

Option 2 – Become a founder, earn a not-so-competitive salary, get a shot at running a high potential company, and participate meaningfully the financial outcome - all with others footing the bill along the way (and no personal guarantees if you fail).

Just about everyone in the class chooses Option 2. It just has to be reframed properly.

New Deal Analysis Report coming next week

For Premium Community Members, we will be releasing a new deal report, Arcade Therapeutics, currently raising on Wefunder.

Arcade Therapeutics

Have a great weekend, everyone! We’d be grateful if you could forward this newsletter to anyone in your network and invite them to the Democratize Venture party!

Sincerely, -gerry ([email protected])

Reply